Explaining Net Effective Rent and What it Means for Chicago Renters

Table of Contents

- What Is Net Effective Rent?

- What’s the Difference Between Gross Rent and Net Effective Rent?

- Let the Robots Do the Math: Use a Net Effective Rent Calculator

- What Factors Influence Net Effective Rent in Chicago?

- Net Effective Rent: The Perks and the Pitfalls

- Apartment Search Tips (From a Leasing Agent Who’s Seen It All)

- Your Net Effective Rent Questions Answered

- Still Confused? Let a Hotspot Agent Walk You Through It

You spot a luxury apartment listed for way less than you expected. We’re talking a rooftop pool, in-unit laundry, prime downtown Chicago location…and somehow the rent is cheaper than your current place? How is that possible?

That eye-popping price might be the net effective rent. It’s a common way buildings advertise deals and discounts, and when you understand how it works, it can open the door to options that might’ve been out of reach at full price. Let’s break down what net rent means, how it’s calculated, and what hidden factors could impact your monthly bottom line so you can rent smart and make the most of these deals when you see them.

What Is Net Effective Rent?

Net effective rent (NER) is basically the average monthly rent you pay over the course of your lease after factoring in any specials or concessions (aka deals that sweeten the pot), like one or two months free.

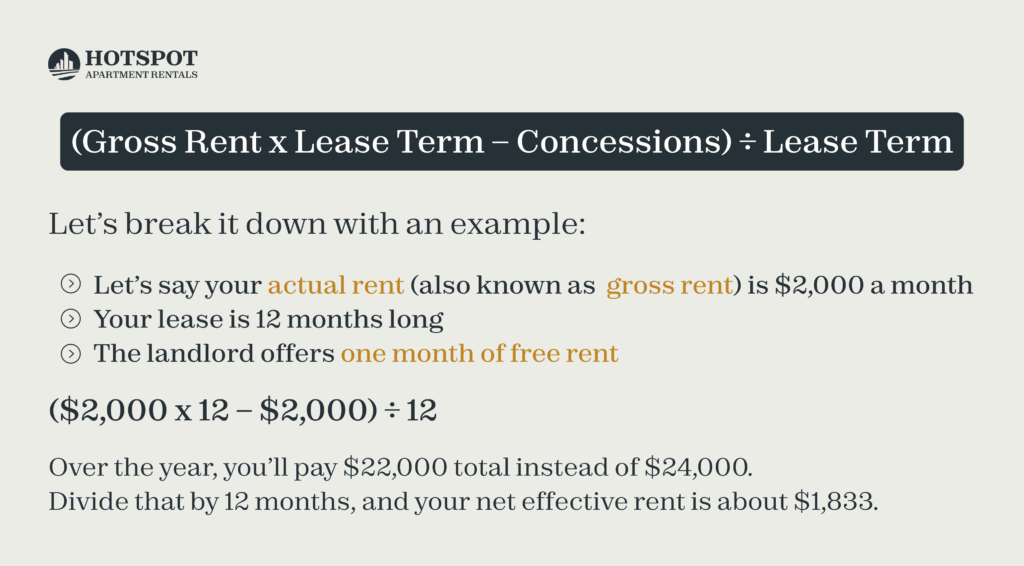

So how does net effective rent work? Here’s the formula:

Why Do Landlords Use Net Effective Rent?

Landlords use net effective rent to fill apartments faster and keep cash flow steady, without cutting into their bottom line. Offering a special that results in a lower “net” price grabs your attention, especially in a competitive market, while keeping the actual base rent intact. Enticing renters with perks like a free month or a flat rent credit without lowering the market rent amount helps protect future comps and building valuations.

So, while your lease still says $2,000 per month, your effective cost is less, thanks to the discount spread out over time. Net effective rent helps you compare deals, but it’s not always what you’ll actually owe each month.

That’s why it’s important to know the difference, especially when budgeting.

What’s the Difference Between Gross Rent and Net Effective Rent?

Gross Rent: What You Actually Pay Each Month

Gross rent, also known as market rent, is the full amount of rent you agree to pay each month before any deals or discounts. It’s the number written in your lease and the amount you’re responsible to pay every month.

Example:

If your lease says you pay $2,200 every month for your apartment, that’s your gross rent. Even if the building gives you a free month (or some kind of special offer), your gross rent stays the same.

Simply put, it’s the “real” price, without any math tricks.

Net Effective Rent: Your Average Monthly Rent When Including Deals

Net effective rent is often different from what you actually pay each month—but not always. It’s the average monthly rent after factoring in concessions, like free rent or credits, spread over the lease term. In some buildings, you may be able to pay that lower net amount each month, depending on how the deal is applied.

Example:

Let’s say the rent for an apartment is $2,200 a month, but the landlord gives you one month free on a 12-month lease. Even though you’ll pay $2,200 eleven out of twelve months, your net effective rent is $2,017, because of that freebie.

Let the Robots Do the Math: Use a Net Effective Rent Calculator

Good news! You don’t need to channel your inner mathlete or dust off that calculator from 9th grade algebra. Figuring out your net effective rent sounds complicated, but there’s no need to crunch the numbers yourself.

There are plenty of free online Net Effective Rent calculators that will do the heavy lifting for you. All you need to do is plug in a few key details:

- Your monthly rent (the gross rent listed on your lease)

- Your lease length (usually 12, but sometimes longer)

- The number of free months you’re being offered (bless the concessions)

- Any other bonuses, like waived move-in fees or rent credits

In seconds, you’ll get your true average monthly cost (aka your net effective rent) without any spreadsheet stress or mental math marathons.

What Factors Influence Net Effective Rent in Chicago?

If net effective rent feels like a moving target, it kind of is. The number you see depends on all sorts of behind-the-scenes factors, from what time of year you’re renting to how many empty units a building is trying to fill. Luckily, our team of expert leasing agents has their finger on the pulse of Chicago’s rental market. We know which buildings are cutting deals, where the hidden gems are, and when to strike.

Here’s a peek behind the curtain at what affects net effective rent in Chicago:

Types of Incentives You’ll See in Chicago

Buildings love to sweeten the deal. In Chicago, you might be able to score:

- Rent concessions (like your first or second month free, or a $1000 one-time credit)

- Waived admin fees (often offered as a “look and lease” specials, given if you apply within 24-48 hours of your first showing)

- Discounted parking (a legit unicorn in some neighborhoods)

- Gift cards (yes, some buildings are basically bribing you, in the best way!)

These perks all lower your effective monthly cost, even if they don’t touch your gross rent.

Timing is Everything: Seasonality & Neighborhood Trends

Here’s a secret: the rental market has mood swings. Summer is hot (literally and financially), but winter? That’s when landlords start getting generous. If you’re cool with moving to Chicago in January, you might land a bigger discount just because demand is lower.

And neighborhoods matter too. Some areas have tons of shiny new buildings competing for attention (hello, West Loop), while others stay steady year-round. The more competition, the more likely you are to get a juicy concession.

Vacancy Rates & the Power of Competition

When buildings have too many empty units, they get creative. Especially Chicago’s brand-new apartments. After all, those glossy high-rises with rooftop pools and dog spas don’t fill themselves! So if a building is brand new (or halfway leased and starting to sweat), you’re more likely to see big-time deals.

Bottom line? Net effective rent isn’t just about math—it’s about timing, location, and strategy. And that’s where we come in. We’ll help you read between the rental lines and make sure that “limited-time offer” matches your needs and budget.

Net Effective Rent: The Perks and the Pitfalls

What you’ll love about net effective rent:

- Lower Average Monthly Rent: Stretch your budget!

- Luxury for Less: Scoring a deal might let you lease in a building with extra amenities.

- Shiny and New: Net pricing is common in brand-new buildings looking to fill units fast.

- True Value of the Apartment: Net effective rent shows you the true value of an apartment over your lease term. It’s the big-picture price, and for many renters, it leads to an “ah-ha” moment when comparing apartment options.

What you may not love:

- Potential Renewal Sticker Shock: Your first-year rent averaged out to a sweet “net” rate thanks to move-in specials, but when renewal rolls around, your new rate will likely reflect the market rent. So even if you weren’t paying that lower amount each month, the jump can still feel real when the deal disappears.

- Lease Reality Check: Your lease reflects the full (gross) rent, not the lower net price you’ve been hearing about.

- Intentional Budgeting Required: If your rent concession is front-loaded, you may need to set money aside at the beginning of your lease so that you can cover the full market rent in future months.

Apartment Search Tips (From a Leasing Agent Who’s Seen It All)

If you’ve ever hunted for an apartment in Chicago and felt like you needed a decoder ring to make sense of the listings, you’re not alone. Net effective pricing can make things murky, but with the right tips and a solid assist from your leasing agent, you can spot a deal and know exactly what you’re signing up for.

How to Spot Net Effective Pricing in a Listing

Let’s start with the basics. If the rent sounds too good to be true, it probably involves net effective pricing. Look for phrases like:

- “1 month free on a 12-month lease.”

- “Net rent shown”

- “Advertised rent reflects concessions”

- “Price shown is net effective of promotion”

- “Special pricing for limited-time”

Translation? The monthly rent you see advertised isn’t always what you’ll pay each month. If a West Loop one-bedroom is listed at $2383 but similar units go for $2,600, that lower number probably reflects a discount averaged over the lease—not your actual monthly payment.

The Questions You Should Always Ask

Take it from someone who’s toured thousands of Chicago apartments: always ask the right questions:

“What will I actually owe each month?”

Ask for the gross rent (not just the advertised net rent), and find out how any concessions—like a free month or rent credit—are applied. Some buildings apply the discount up front, but others let you spread it out over your lease term, which means you can effectively pay the lower net rent each month. Knowing this helps you budget with confidence and avoid surprises.

“What happens when I renew?”

That sweet discount probably won’t carry over next year. Buildings tend to base their renewal offers on the full market rent rate, so it’s good to ask in advance what to expect at renewal time.

Tips for Negotiating Beyond the Incentive

Here’s a secret: sometimes we can negotiate for more than the original move-in special. Especially if:

- The building has lots of availability

- You’re moving during a slower season (hello, January)

- You’re ready to sign quickly

We’ve negotiated waived pet fees, an extra rent credit, and even a few months of free parking.

Your Net Effective Rent Questions Answered

You asked, we answer. Here’s the no-fluff, real-talk breakdown of what net effective rent actually means.

Is net effective rent the same as actual rent?

Nope. Net effective rent is the average rent you pay each month after discounts like a free month or waived fees are factored in. Your actual rent (also called gross or market rent) is the amount listed in your lease and what you’ll typically pay each month. So if a listing says $1,900, your real monthly payment could be more.

What happens to a discounted rent when the lease is up?

In most cases, the discount goes away. When it’s time to renew, the building will likely base your new rent on the full gross amount, not the discounted net rate. Translation: don’t expect those sweet freebies to roll over. That said, it never hurts to ask for a concession at renewal!

Why do some buildings advertise net effective rent instead of gross rent?

Because it looks better. Lower net pricing helps a listing stand out, especially in competitive markets. It’s marketing, plain and simple.

Will I need to show proof of income based on the gross rent or the net effective rent?

Usually, it’s based on the gross rent. Requirements can vary, so ask your leasing agent—but most properties use the market rent amount (before discounts) to calculate income qualifications.

Can net effective rent affect how much I pay up front?

Yep. If the special—like a free month—is applied at the start of your lease, your first payment could be lower (or even $0), and you’ll pay the full gross rent after that. But if the discount is spread out over the lease, you might get to pay the lower net effective rent each month. Always ask when and how the deal is applied—it makes a big difference.

Can I negotiate net effective rent deals?

It never hurts to try! While larger, professionally managed buildings usually keep gross rent firm, there’s often wiggle room elsewhere. Try negotiating for perks like a free or discounted onsite storage locker, a waived move-in fee, or waived pet fees. This works best in new buildings or during slower seasons when management is eager to fill units.

Is net effective rent a bad thing?

Not at all! It can be a great way to get more apartment for your money, especially in luxury or brand-new buildings. Just make sure you understand the difference between what’s advertised and what you’ll actually pay each month, so you can budget like a pro and avoid surprises.

Still Confused? Let a Hotspot Agent Walk You Through It

Don’t worry, you’re not alone. Net effective rent can be confusing even for seasoned renters, and that’s exactly why we’re here to help. At Hotspot Apartment Rentals, we live and breathe the Chicago rental market. Our team knows which listings are offering real value, where to find the best deals, and how to decode the fine print so you don’t have to.

We run net effective rent calculations every day, so if you’re not sure how a deal breaks down, just ask one of our agents to help. We’ll happily do the math for you! Ready to find your next apartment? Reach out to us anytime, and we’ll match you with a place that fits your lifestyle and your budget. Because renting in Chicago shouldn’t require a math degree, just a Hotspot agent.

Similar posts

-

Advice and Tips

Apartment Living

Chicago Neighborhoods

Search Tips

Chicago’s Best Hidden Parks (and Where to Live Near Them)

-

Advice and Tips

HotSpot Picks

Luxury Apartments in Chicago

Search Tips

The Most Fitness-Friendly Apartments in Chicago

-

Advice and Tips

Chicago Neighborhoods

Luxury Apartments in Chicago

Search Tips

Best Chicago Neighborhoods for College Graduates: Where to Live After Graduation