Renting vs Buying in Chicago: What’s Best in 2025?

Table of Contents

Whether you’re a renter or home-owner, you’ve certainly had your eye on the housing market. Prospective buyers have seen interest rates go from crazy-low to just plain crazy. And for those who rent, the vacancy rates, new development and rent prices in downtown Chicago apartments have been on a rollercoaster since the Covid-19 pandemic.

If you’re contemplating a move and wondering if renting versus buying is better, there are many factors to consider. Gauging whether it’s cheaper to rent or buy depends on several variables too.

Understanding the Chicago Housing Market

The housing market in and around downtown Chicago is dynamic, with options that cater to both buyers and renters. For buyers, the allure lies in a diverse range of options. From historic brownstones to modern high-rises, you can purchase a home with architectural charm or a new condo perched on the city’s skyline.

Meanwhile, renters find themselves spoiled with incredible luxury apartments that boast contemporary design, over-the-top amenities, and your choice of Chicago’s best neighborhoods.

2025 Chicago Housing Market Trends

Several factors are shaping Chicago’s housing market, reflecting a blend of local dynamics and broader national influences. One key trend is the slow but steady rise in home prices, driven by a combination of limited inventory and continued demand from buyers, despite tough-to-swallow interest rates. Even though Chicago’s current market is neutral, rising sale prices have made affordability a growing concern for many want-to-be homeowners, particularly first-time buyers.

Our team at HotSpot Rentals saw a sharp dip in rent prices as the pandemic took hold of the city in 2020, but those lower than normal rents vanished as demand for luxury apartments came roaring back. Rent prices in Chicago continue to rise in 2025, especially in high-demand areas like River North and Lincoln Park. And even though downtown rent prices are outpacing income growth, new apartment development continues at a rapid pace.

Should You Rent or Buy in Chicago?

How Much Is Rent in Chicago?

Rent prices in Chicago fluctuate daily. But on average, the monthly rent for an apartment in Chicago typically hovers around $2,150. A smaller footprint, like a studio apartment, is typically more affordable, while the average rent on a two or three-bedroom apartment in Chicago is closer to $3,600.

The type of building you live in will also impact your rent. Rent an apartment at a brand-new high-rise with a prime location, and you’ll pay more. But there are lots of affordable apartment buildings in Chicago too. While they may offer fewer bells and whistles, they also come with cheaper rent.

How Much Is Buying a Home in Chicago?

In December 2023, the median price of a home in downtown Chicago was $390,000. This includes single-family homes, townhomes, and condos.

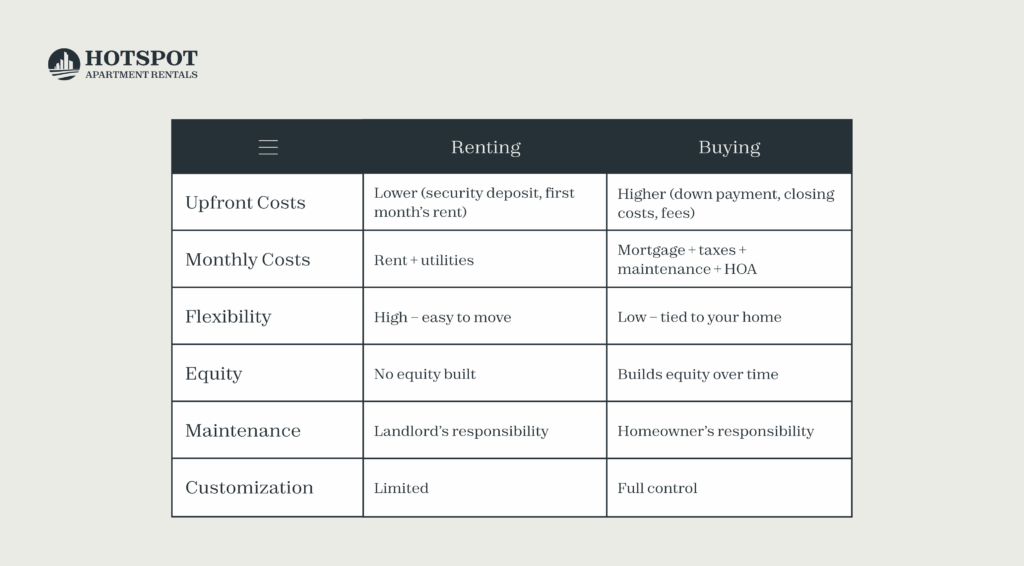

So which choice makes the most financial sense – renting or buying? It all depends on your situation, of course. If you’re considering buying, you’ll spend more upfront – a down payment, real estate fees, closing costs, home inspection, and appraisal – the costs of buying a home add up. The ongoing expenses of home ownership should be budgeted for too, as well as HOA fees if you’re purchasing a condo or townhome. But – buying a home could be a fantastic investment that pays off when it comes time to sell.

For some people, renting makes better financial sense. You’ll spend less money up-front and pay nothing extra for home maintenance or HOA fees. However renting may also limit your ability to build equity and wealth.

Pros and Cons of Renting in Chicago

Renting an apartment in Chicago has both advantages and disadvantages. On the positive side, renting provides flexibility, allowing you to easily relocate or move to a different neighborhood without a long-term commitment. Renting also gets you access to luxury amenities like fitness centers, rooftop decks, and even coworking spaces. And let’s be honest – having maintenance a phone call away makes renting stress-free.

However, there are drawbacks to renting in Chicago. Rent prices in the best neighborhoods can be high. And when you live in a place you don’t own, you don’t have the freedom to make it completely yours. While small cosmetic changes may be approved by management, retiling your shower isn’t going to fly.

Pros and Cons of Buying in Chicago

Buying a home in Chicago comes with its own set of advantages and disadvantages. The biggest pro is the equity, but not being under the thumb of a landlord is a huge bonus too. Being able to put your stamp on your home, take on renovation projects, and feel that pride of ownership is rewarding in so many ways. And then there’s community. The sense of belonging – whether it’s in a condominium building or neighborhood – fosters the kinds of connections that make your house a home.

The biggest downside to owning a home is those unexpected expenses. And while being a homeowner can be rewarding, it’s also time-consuming. General maintenance can gobble up your weekends, leaving you with less free time. Additionally, owning a home ties you down to a specific location, limiting flexibility in terms of relocation.

Best Areas to Rent in Chicago

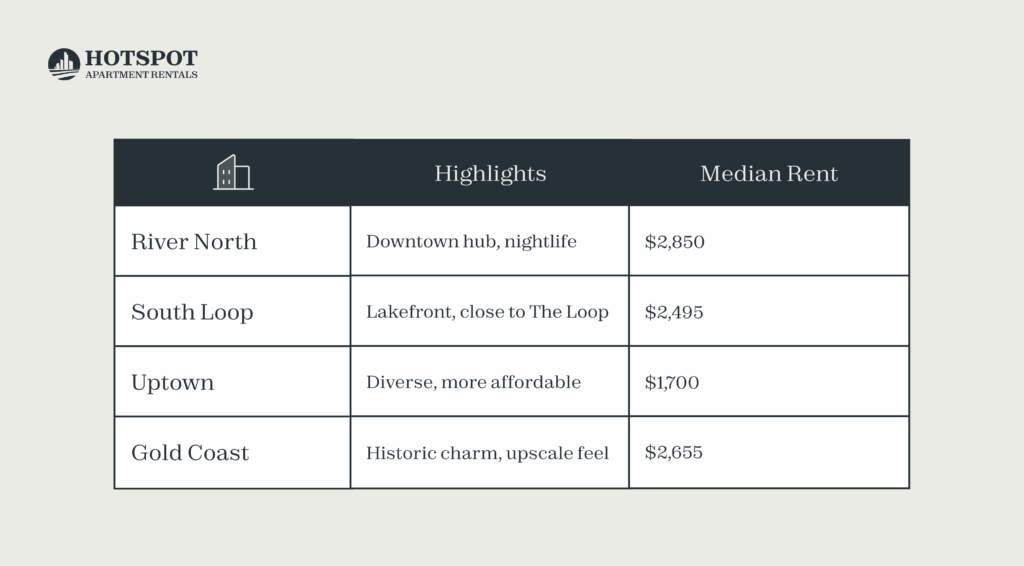

Nestled amidst the iconic skyline of downtown is a vibrant mix of neighborhoods, each with its own unique vibe. Working with a leasing agent is the best way to land in the neighborhood that fits you best. The neighborhoods we love to show off to potential renters are:

River North

- A central downtown location

- Close to dining and entertainment

- Median Rent: $2,850

South Loop

- Just south of downtown’s Loop

- Lakefront access

- Median Rent: $2,495

Uptown

- Six miles north of the Loop

- Culturally diverse

- Median Rent: $1,700

Near North Side / Gold Coast

- A great downtown location

- Rich in history and neighborhood charm

- Median Rent: $2,655

Best Areas to Buy in Chicago

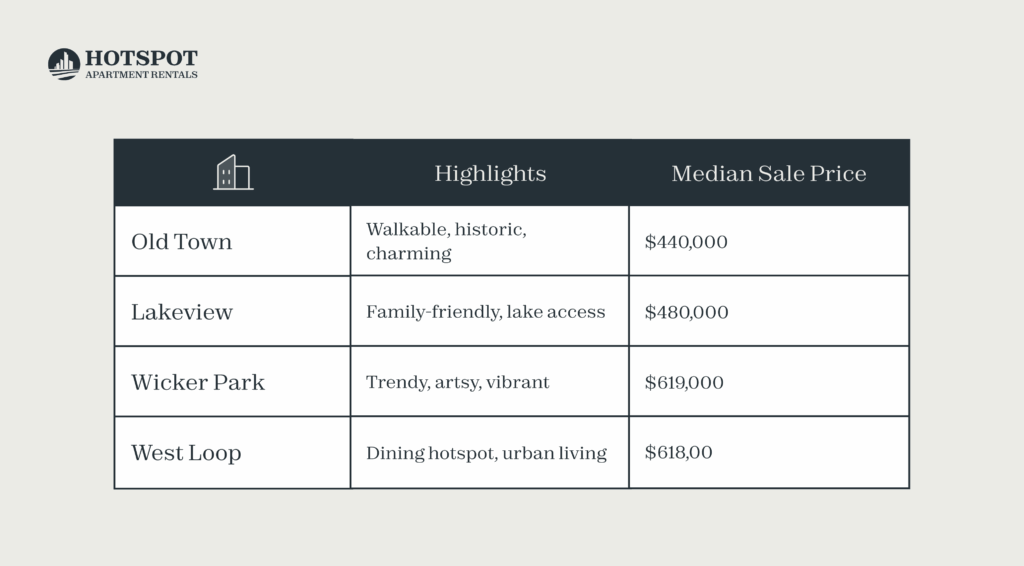

Looking to buy a home in downtown Chicago? Popular neighborhoods to buy in include:

Old Town

- Two miles north of downtown

- Abundant community spirit and neighborhood charm

- Median Home Sale: $440,000

Lakeview

- Five miles north of downtown

- Lakeshore access and family-friendly vibe

- Median Home Sale: $480,000

Wicker Park

- Two miles northwest of downtown

- Awesome urban dining and shopping scene

- Median Home Sale: $619,000

West Loop

- Just west of downtown

- Known for the best restaurant scene in the city

- Median Home Sale: $618,000

To Rent or To Buy in Chicago

So, to buy or to rent? The choice ultimately depends on your individual circumstances, preferences, and financial considerations. While homeownership offers the potential for equity buildup, stability, and the opportunity to take on home projects, it also comes with upfront costs, ongoing maintenance responsibilities, and less flexibility in terms of relocation.

On the other hand, renting provides flexibility, fewer upfront costs, and less responsibility for maintenance, but may limit long-term wealth-building opportunities.

In a city as diverse as Chicago, both buying and renting are viable options. Keep a close eye on market trends and make sure your choice aligns with your own goals and lifestyle.

Similar posts

-

Advice and Tips

Apartment Living

Luxury Apartments in Chicago

Understanding the Chicago Apartment Application Process

-

Advice and Tips

HotSpot Picks

Luxury Apartments in Chicago

Search Tips

The Most Fitness-Friendly Apartments in Chicago

-

Advice and Tips

Luxury Apartments in Chicago

Relocation Advice

Your Guide to Moving to Chicago